Credit is a tricky thing. It’s like surfing – you’re gonna go up, and you’re gonna go down. And when you go down, it feels like you’re going to drown.

I hate even talking about it because everyone’s situation is so different! However, I am finally (finally!) part of the “good credit” (700+) club, and wanted to share some of my tips, tricks, and ideas to get you started on increasing your credit score as well.

How I Raised My Credit Score by 200 Points

1. Realize a few things:

I’m not an expert by any means, and this has mostly been trial and error for me. As of two years ago, I knew very little about credit, and understood even less. I went to a “credit expert” that gave me all kinds of shitty advice. I followed it, and my score actually went down. I got fed up, started doing my own thing (which I show you how to do in this post), and my score went from the high 400s to over 700.

Improving credit takes time. Damaging it does not. What I mean by this is, you can work really hard on building your credit score for years and years, and one or two things can completely destroy it – depending on what those things are. In my experience, credit is a fragile thing and you must always be conscious of the decisions you’re making and how they can affect your score.

I do not own a house (yet!), and we do not have car payments. I have heard that both of these things (a mortgage and/or car loan) can increase your credit score significantly. While we are in the process of buying our first house, we never want to have a car payment. We pay cash for everything we possibly can, which is another reason our credit sucked so bad when we started working on it.

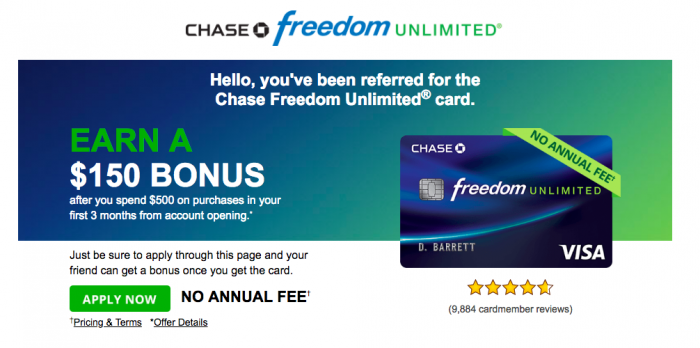

I bought my first home in 2016 and am selling it this year (2018) due to a divorce. I’m now renting until I find the perfect house for my smaller family. :) The FASTEST way I built my credit is by using this reward credit card. You can get $150 cash back if you spend $500 in the first 3 months.

What works for me might not work for you, and vice versa. However, the tips I’m giving you here are somewhat universal and should help improve your score. Based on your current situation, do some research before jumping in, because the last thing you want to do is lower your score!

2. Sign up for a free account at creditkarma.com – yes, it’s legitimately free, no they’re not paying me for this post (but if you know them, send ’em my way so I can get paid, cuz it’s an awesome post, yo). You do not put credit card information in. Use the “credit simulator” tool to see where your score will be (it’s fairly accurate) if you open a new card, close a card, get a loan, or whatever else.

Then, get a full credit report for free at annualcreditreport.com – you can request this once per year. It’s a federal regulation or rule of some sort. Don’t sign up for any of their extra crap. It gets expensive.

3. Sign up for new credit card(s). This step includes three parts:

Part 1

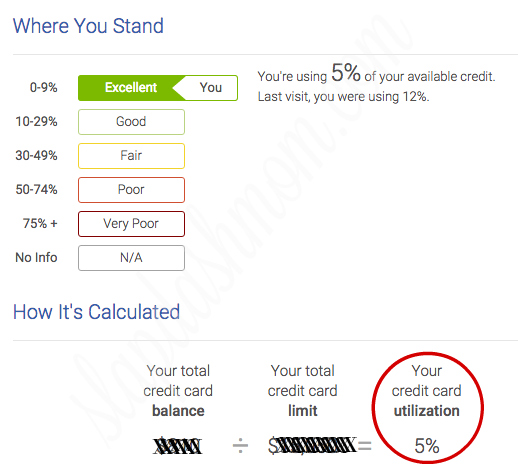

Understand credit cards and how you should use them. The goal here is not to open a bunch of new credit card accounts and spend in a crazy way, which I’m sure you know. However, did you know that even utilizing 30% of your overall credit card limit can lower your score (or keep it from going up)?

The FASTEST way I built my credit is by using this reward credit card.

When I was utilizing even 12% of my credit card limit, my score was stuck for a few weeks. I paid off some more balances, paid down one of my small cards, got an increase on another card, and my utilization went down to 5%. My score instantly increased 7 points according to one report, and 34 according to another! That’s a huge increase.

Use your cards and pay them off monthly. Keep a low balance, if you keep one at all. Utilizing less than 10% of your credit card balance is tough, but it’s ideal.

Another thing you’ve gotta understand: hard inquiries can and/or will hurt your credit score. I don’t care how many people SWEAR to me that they won’t, I’ve lived it. I’ve watched it happen to my own credit. It happens, especially when you have a low credit score. You have to weigh the good and the bad. Is it worth dropping a few points in order to go up several points in the long run? Generally speaking, yes it is.

I can’t tell you how pissed off I was that my mortgage guy kept dragging his feet and dragging out my credit checks. Because he literally doesn’t understand how to move quickly, he pulled my credit THREE times. The first two times, it dropped my score by about 10 points (each time!). The third time, I had already increased my score to 650, and it only lowered it by only 3 points. Don’t let someone pull your credit unless it’s necessary.

Part 2

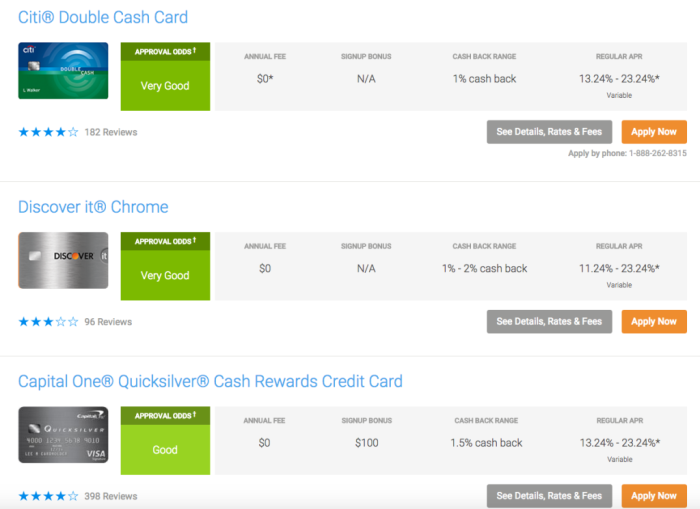

Assuming you follow directions, you’re already signed up for Credit Karma; so just click “My Recommendations” to get started.

Check for these things:

APR – You want a low APR, but that isn’t usually possible with bad credit. Heck, even with “good” credit, I get offers with 24% interest. Credit cards are expensive! That means if you make a $1,000 purchase, you’re paying 24% on it. Do the math. Not cool. So, do what you can to get a lower interest credit card. After you’ve had it for a while (say, a year, with no late payments), call and ask them to reduce your interest rate. Usually they will, even if it’s just by a percent (which adds up!).

Annual Fees – Some cards charge an annual fee of $99, so watch out for that. Not only could the $99 put you over your limit (which means lowering your credit score, getting over the limit charges, etc), it could also overdraft your bank account if you have automatic payments set up (which I do/don’t recommend; see below).

Approval Odds – Unless it says “good” or “very good”, I don’t apply. If your best option is “fair”, then go for it (I had to at the beginning).

Member Ratings – If it has 3 stars or less, I steer clear. 4 or 5 stars? Go for it. Find out why other members rate the card(s) they way they do, and decide whether those things are important to you.

Is it a secured card? If you have terrible credit, you’ll most likely have to sign up for a secured credit card. The first one I signed up for had a minimum of $200. So, I saved up $200 (which took forever), and sent it to be put on a secured credit card. This means they have my $200, until I close my card (which will lower your credit, so don’t close it!). This is tough to do, especially when you’re struggling financially or living paycheck to paycheck, but it truly is the first step to improving your credit score.

Part 3

Sign up for an in-store credit card. Whether it’s at Sears, Kohl’s, Macys, Dillard’s or wherever else, sign up for one in-store credit card to start (you can actually do this online as well). I am up to four cards now, all at places I either don’t ever shop at, or can control myself at. I’d never sign up for a Wal-Mart credit card, and signing up for a Torrid card was a huge mistake because I’d drop $1,000 at Torrid without blinking. Because I have zero self-control in that store, I tore the card up after the first time I used it.

MISTAKE I MADE: I signed up for a Barclay card and bought an iMac desktop computer (best investment ever, by the way). The limit was $2,000 and the computer cost $1980. This was a big mistake. Why? Because now my credit card utilization for that card was almost 100%! Now what?

HOW I FIXED IT: At first, I couldn’t afford to pay more than like $100 a month on the card. I knew I was going to get absolutely annihilated when the interest kicked in (I had free interest for 12 months), so I worked my ass off as a Virtual Assistant to make more money. In four months, I paid the card off. This increased my score quite a bit.

4. Look over your credit report with a fine-toothed comb. If there are any inquiries on your report that you did not approve of, dispute them. If there are any negative marks, dispute them. Some suggest disputing legitimate claims if they’re old, because they might just get taken off. I don’t like the idea of doing that, because I feel like if I spent the money or did whatever it was to get the item on my credit, I need to take care of it not just get it taken off. However, whatever you feel comfortable with is what will work best for you.

If you decide to pay off what you owe, when you call your creditors, ask for a settlement offer. Depending on how big of a hurry you’re in to increase your credit score, you might be able to play a little hard ball here. Last year, I called a medical creditor that said I owed $480. I asked for a settlement and they said absolutely not. I left it alone until a few months ago, and called them back. I asked what their best offer was. It ended up being $240. I paid it, without hesitation, because I knew that was as good as it was going to get … and I wanted to raise my credit score some more!

5. Pay off your debts. I kind of covered this in Step #4, but it’s important to realize that until you pay off your debts, your credit score will only go up a little bit (if at all), and will stop at some point. If you owe $10,000 and think you can never afford to pay it off, call and set up a payment plan. Most creditors will work with you. If they won’t work with you this month, try again in a few months. Ask for their “best offer”. You don’t have to be bitchy, but be firm. Don’t beg them and say you need this or that off your credit report – be professional but assertive.

FAQ

Setting up automatic payments on credit cards: good or bad?

I say it’s both. On one hand, setting up a payment for only the minimum means your payment will post in time and you won’t get a ding on your credit for a late payment. On the other hand, that means you’re only paying the minimum, which I never recommend.

What if none of this will work for me because I’m completely flat broke?

#1, get a job. I don’t mean that in a snippy “you’re a loser if you don’t have a job” type of way, I mean it in the “tax refunds are freakin’ awesome when you’re poor” kind of way. Two reasons: tax refunds, and proof of income when buying a house. When I was working a minimum wage job and had two kids to claim, my tax refund was $5,000! That’s a lot of money. Secondly, without a job you aren’t getting a house!

#2, where there’s a will, there’s a way. If I can figure it out (remember, I was homeless not too long ago), so can you. Prioritize and make it happen. (Need to make more money? Become a Virtual Assistant.)

#3, you’ll need a job or some type of income if you want to get a loan for a house, car, etc.

How long does it take?

This is different for everyone; raising my score 100+ points took only about 7 months of me actively working on my credit. However, the last 100 points were much easier than the first 100 points. So, I think it just depends on lots of things: how low your score is, your credit history age, if you have any derogatory marks, how much your credit card balances are, etc.

Is Credit Karma accurate? I heard it wasn’t.

Yes and no. Credit Karma gives you scores from two of the three credit bureaus. Based on my experience, they’re close to the same as what my mortgage lender told me his scores showed for myself and for Rachel while getting pre-approved for a mortgage loan. For more options to check your credit score, visit CafeCredit.com.

What if I have a bunch of derogatory marks on my credit and can’t pay them off?

Bottom line is, you’re going to have to pay them off or file bankruptcy. Read my tips about asking for settlements. Rachel’s score was about the same as mine, but I had a judgment ($1,800) on mine. I opened a store credit card for her, made one purchase, set her card up on automatic minimum payments (it’ll be paid off before the interest kicks in), and her score jumped from the low 500s to nearly 700! Just from doing one thing! I was really annoyed, of course, because I had been working on mine for months at this point and it had barely moved. I paid the judgment off, opened a few credit cards, and paid off the ones I had balances on. That’s what has helped me the most.

Leave a Reply